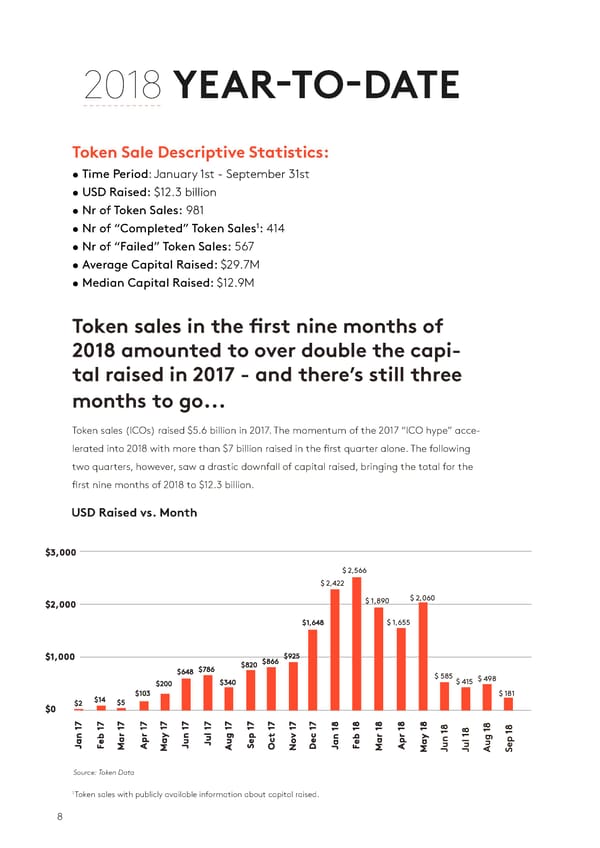

...but 58% of token sales failed to raise capital, 2018 YEAR-TO-DATE disappeared, or refunded participants Breakdown of token sale status: Token Sale Descriptive Statistics: • Time Period: January 1st - September 31st • 414 (42%) “Successful” token sales: token sales with public data on • USD Raised: $12.3 billion proceeds • Nr of Token Sales: 981 • 567 (58%) “Failures”: token sales that either reported a full refund of token sale pro- ceeds to participants, or failed to disclose any data on the completion of fundraising at 1 • Nr of “Completed” Token Sales: 414 2 • Nr of “Failed” Token Sales: 567 all. • Average Capital Raised: $29.7M • Median Capital Raised: $12.9M Besides the significant increase of capital raised in 2018, the number of token sales that have taken place by the end of September (981) is already ahead of the 900 token sales Token sales in the first nine months of that occured in all of 2017. Unfortunately, to the most port, it is a surge in low quality projects that accounted for the increase, leading to a higher percentage of “failed” 2018 amounted to over double the capi- token sales - rising from 48% in 2017 to 58% in 2018. tal raised in 2017 - and there’s still three Ten Token Sales Raised 47% of All Capital months to go... Token sales (ICOs) raised $5.6 billion in 2017. The momentum of the 2017 “ICO hype” acce- A closer look at the largest token sales shows that over 47% of all capital raised came lerated into 2018 with more than $7 billion raised in the first quarter alone. The following from the 10 largest token sales (1% of the total number of active token sales). Moreover, two quarters, however, saw a drastic downfall of capital raised, bringing the total for the close to 40% of all capital came from two token sales: Telegram and EOS. first nine months of 2018 to $12.3 billion. USD Raised vs. Month Project Sector Raise EOS Infrastructure $3,165,000,000 $ 2,566 Telegram Open Network Infrastructure $1,700,000,000 $ 2,422 $ 2,060 Bankera Finance $150,000,000 $ 1,890 t0 Trading $134,000,000 $ 1,655 Basis Infrastructure $125,000,000 Orbs Infrastructure $118,000,000 $ 585 $ 415 $ 498 PumaPay Finance $117,019,041 $ 181 Envion Finance $100,012,279 Hedera Hasgraph Infrastructure $100,000,000 un 18 ul 18 ug 18 ep 18 Flashmoni Finance $72,000,000 J J A S Source: Token Data Source: Token Data 2 1 This includes token sales that claim success, but have not published information about funds raised and/or Token sales with publicly available information about capital raised. token sale contract. 8 9

State of the Token Market Page 7 Page 9

State of the Token Market Page 7 Page 9