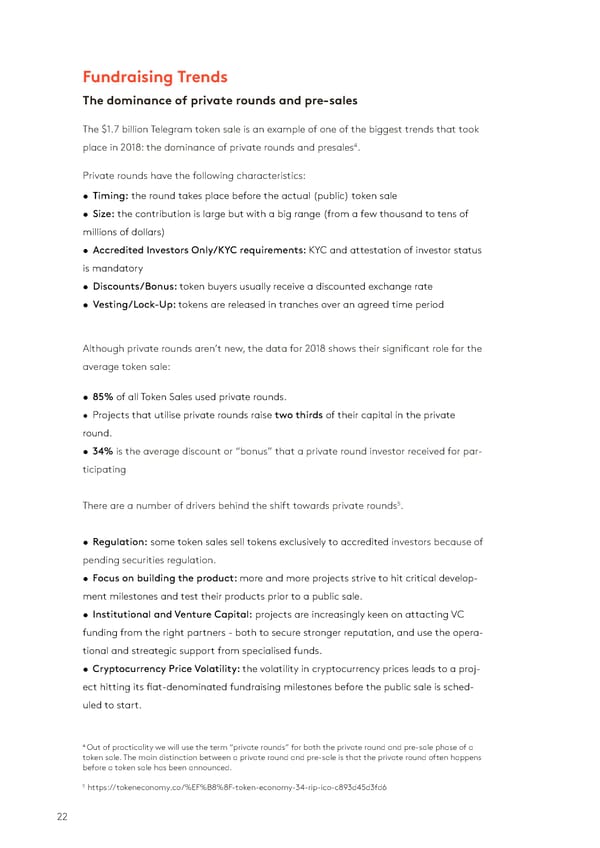

Fundraising Trends VC funding The dominance of private rounds and pre-sales A continuous growth in Venture Capital funding into blockchain projects over the past 7 years The $1.7 billion Telegram token sale is an example of one of the biggest trends that took 1.800 4 place in 2018: the dominance of private rounds and presales . 1.600 Private rounds have the following characteristics: 1.400 • Timing: the round takes place before the actual (public) token sale 1.200 • Size: the contribution is large but with a big range (from a few thousand to tens of 1000 millions of dollars) • Accredited Investors Only/KYC requirements: KYC and attestation of investor status 800 is mandatory 600 • Discounts/Bonus: token buyers usually receive a discounted exchange rate 400 • Vesting/Lock-Up: tokens are released in tranches over an agreed time period 200 0 Although private rounds aren’t new, the data for 2018 shows their significant role for the 2012 2013 2014 2015 2016 2017 2018 average token sale: Numbers of Rounds Round Size ($m) Source: Coindesk • 85% of all Token Sales used private rounds. 10 Biggest Venture Rounds • Projects that utilise private rounds raise two thirds of their capital in the private Robinhood - 2018 > $350m round. DST Global, Sequoia Capital, Kleiner Perkins, ICONIQ Capital, CapitalG • 34% is the average discount or “bonus” that a private round investor received for par- 21 Inc - 2015 > $116m ticipating Andreessen Horowitz, Data Collective, Khosla Ventures, RRE Ventures, Yuan Capital, Qualcomm Ventures, Pantera Capital, Jeff Skoll Group, Founders Fund, and others Circle - 2018 > $110m 5 Accel, General Catalyst, IDG Capital, Breyer Capital, Bitmain, Pantera Capital, BlockChain Capital, DCG, There are a number of drivers behind the shift towards private rounds . Tusk Ventures Coinbase - 2017 > $108m • Regulation: some token sales sell tokens exclusively to accredited investors because of Institutional Venture Partners, Battery Ventures, Draper Associates, Greylock Partners, Section 32, Spark Capital, Tusk Ventures, Kindred Ventyres, Balyasny Asset Management, Expanding Capital, Shanti Bergel pending securities regulation. R3 - 2017 > $107m • Focus on building the product: more and more projects strive to hit critical develop- Bank of America Merrill Lynch, HSBC, Intel, SBI Group, Temasek Holdings, Banco Bradesco, Barclays PLC, ment milestones and test their products prior to a public sale. ING Group, Itau Unibanco, Natixis, UBC, Wells Fargo, and others PINTEC - 2018 > $103m • Institutional and Venture Capital: projects are increasingly keen on attacting VC Zhong Capital Fund, SINA Corporation, Shunwei Capital, Mandra Capital, STI Financial Group funding from the right partners - both to secure stronger reputation, and use the opera- Coinbase - 2015 > $75m tional and streategic support from specialised funds. DFJ, Union Square Ventures, New York Stock Exchange, Vayner/ RSE, Valor Capital Group, USAA, Reinventure Group, BBVA, DoCoMo, Tim Draper, Ribbit Capital, Andreessen Horowitz, Vikram Pandit, • Cryptocurrency Price Volatility: the volatility in cryptocurrency prices leads to a proj- Tom Glocer, Kindred Ventures, Fueled, Propel Venture Partners ect hitting its fiat-denominated fundraising milestones before the public sale is sched- Ledger - 2018 > $75m Draper Esprit, Draper Dragon, Draper Associates, DCG, Korelya Capital, XAnge, MAIF, GDTRE, FirstMark, uled to start. Cathay Innovation, Boost VC, CapHorn Investments Paxos - 2018 > $65m RRE Ventures, Liberty City Ventures, Jay Jordan 4 Out of practicality we will use the term “private rounds” for both the private round and pre-sale phase of a DFINITY - 2018 > $61m token sale. The main distinction between a private round and pre-sale is that the private round often happens before a token sale has been announced. Andreessen Horowitz, Scalar Capital, Polychain, Multicoin Capital, KR1, Amino Capital, Aspect Ventures, Eterna Capital, SV Angel, Village Global 5 https://tokeneconomy.co/%EF%B8%8F-token-economy-34-rip-ico-c893d45d3fd6 Source: Coindesk 22 23

State of the Token Market Page 21 Page 23

State of the Token Market Page 21 Page 23