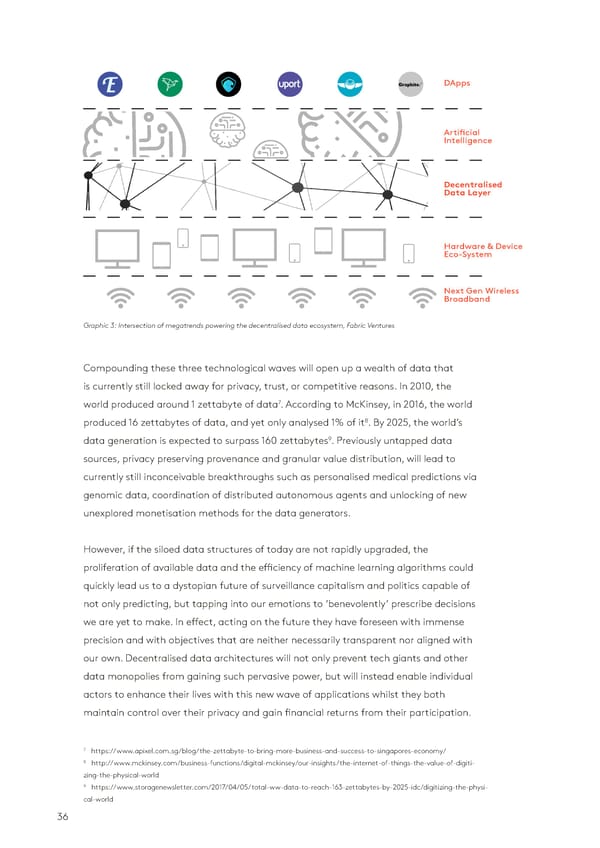

DApps Novelty of tokens & cryptoeconomics A fundamental problem that has historically plagued network architects of all varieties can be simplified down to the mismatch between value creation by a Artificial network and value capture by an equity structure. Equity structures derive their value Intelligence from the future cash flows generated by the central company’s ability to extract revenues from its customers at a net profit. A system that worked well for companies Decentralised Data Layer selling goods and services: Apple selling premium hardware or Netflix and Spotify selling monthly memberships. The equity model does however result in a dangerous divergence of interests when applied to networks in which the core value lies within Hardware & Device the cheap distribution and user driven content creation: Twitter has had difficulties Eco-System monetising the content created by its user base, Facebook had to turn to an almost Next Gen Wireless dystopian & panoptical model to monetise their user base & open source networks Broadband never managed to properly monetise their full value creation. While the community Graphic 3: Intersection of megatrends powering the decentralised data ecosystem, Fabric Ventures generates the valuable content inside a network, the user transforms from the customer to the product itself. The fundamental mismatch lies in the fact that a central entity is attempting to capture the entire value created by the community of Compounding these three technological waves will open up a wealth of data that users, which receives no financial upside in return. is currently still locked away for privacy, trust, or competitive reasons. In 2010, the world produced around 1 zettabyte of data7 . According to McKinsey, in 2016, the world By moving away from a central equity company governing the network, and instead 8 produced 16 zettabytes of data, and yet only analysed 1% of it . By 2025, the world’s modeling the network as a digital economy with a native token, we can not only 9 data generation is expected to surpass 160 zettabytes . Previously untapped data increase the value captured, but also distribute it to the actual value creators. This sources, privacy preserving provenance and granular value distribution, will lead to digital economy uses tokens as manifestations of digital scarcity within a network, currently still inconceivable breakthroughs such as personalised medical predictions via which are used to incentivise distributed people, machines and other actors to genomic data, coordination of distributed autonomous agents and unlocking of new contribute and manage valuable resource, work and usage. Representing the digital unexplored monetisation methods for the data generators. scarcity of the network (e.g. compute power, human labour, content creation or governance) as a digital token renders it upgradable and infinitely flexible. These However, if the siloed data structures of today are not rapidly upgraded, the tokens become a programmable digital software link between humans and the proliferation of available data and the efficiency of machine learning algorithms could assets they own - both virtual (e.g. personal data) and physical (e.g. real estate). quickly lead us to a dystopian future of surveillance capitalism and politics capable of What these tokens enable, is a cleverly architected balance of network-intrinsic not only predicting, but tapping into our emotions to ‘benevolently’ prescribe decisions stake & utility for users, developers, resource providers (e.g. miners), and capital we are yet to make. In effect, acting on the future they have foreseen with immense providers (e.g. investors), achieved through Token Economics - the new frontier for precision and with objectives that are neither necessarily transparent nor aligned with incentive mechanisms design. As tokenisation allows a re-imagining of ownership our own. Decentralised data architectures will not only prevent tech giants and other on a wholesale basis even beyond pure digital assets, existing assets will enjoy the data monopolies from gaining such pervasive power, but will instead enable individual potential for improved liquidity, transparency, access, compliance and taxation which actors to enhance their lives with this new wave of applications whilst they both will drive their tokenisation and the ultimate supremacy of the new crypto capital maintain control over their privacy and gain financial returns from their participation. markets. 7 https://www.apixel.com.sg/blog/the-zettabyte-to-bring-more-business-and-success-to-singapores-economy/ A couple of decades back, we witnessed data and content shifting from analogue 8 http://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/the-internet-of-things-the-value-of-digiti- zing-the-physical-world to digital distribution. This allowed everything from creation to distribution to 9 https://www.storagenewsletter.com/2017/04/05/total-ww-data-to-reach-163-zettabytes-by-2025-idc/digitizing-the-physi- cal-world 36 37

State of the Token Market Page 35 Page 37

State of the Token Market Page 35 Page 37