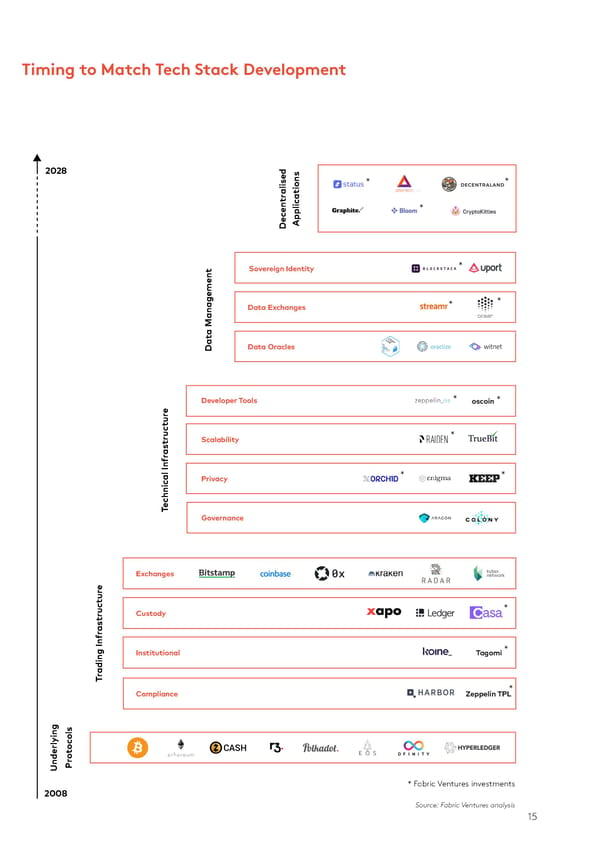

PICKS AND SHOVELS Timing to Match Tech Stack Development first: The Majority of Funding Goes into Infrastructure Projects 2028 ed alis * * tr ations en * ec Applic D t Sovereign Identity * 19,9 % Other40,4 % Infrastructure Data Exchanges * * a Managemen at Data Oracles D 10,2 % Trading e Developer Tools * oscoin * ur t uc Scalability * 14,1 %15,4 % tr as r FinanceConsumer/DApp f al In Privacy * * Source: Token Data echnic T Governance In 2017, nearly 32% of capital raised in the 10 largest token sales went to decentralised infrastructure projects. It is reassuring to see there continues to be a large influx of capital to “picks and shovels”, as more investors focus on Exchanges developer tools and networks forming the core infrastructure layer of the Web e ur t * 3.0 stack. In the first nine months of 2018, 5 of the 10 largest token sales were ucCustody tr held by infrastructure projects.as r f The infrastructure segment stands out also when looking at the overall Institutional Tagomi* number of completed token sales - taking up 40.4% of all ICOs. ading In r T * Compliance Zeppelin TPL ols oc t o UnderlyingPr * Fabric Ventures investments 2008 Source: Fabric Ventures analysis 14 15

State of the Token Market Page 14 Page 16

State of the Token Market Page 14 Page 16