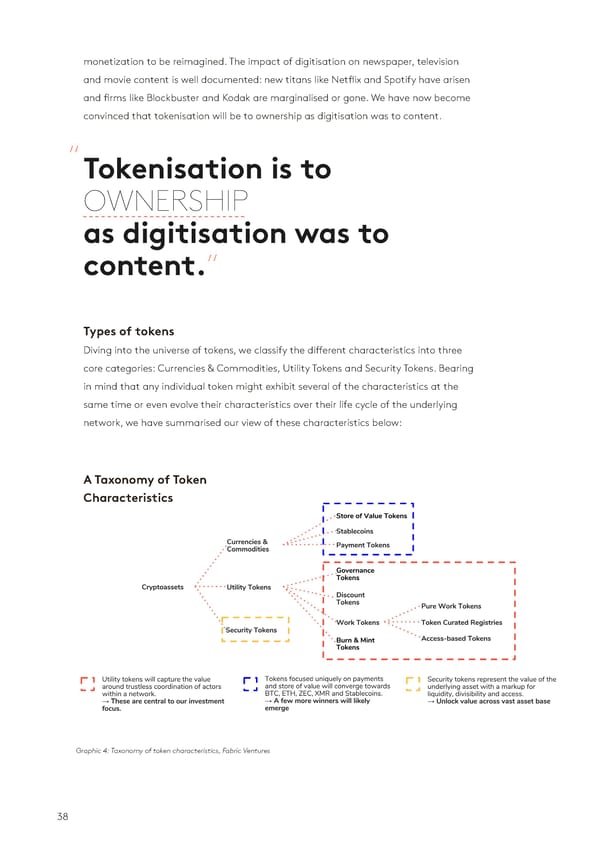

monetization to be reimagined. The impact of digitisation on newspaper, television Store of Value (SoV) Tokens rely on their censorship resistant and peer to peer and movie content is well documented: new titans like Netflix and Spotify have arisen transaction features to ensure a store of value that is completely uncorrelated to any and firms like Blockbuster and Kodak are marginalised or gone. We have now become other market, commodity or currency. Examples include the likes of Bitcoin, Monero and convinced that tokenisation will be to ownership as digitisation was to content. Zcash which all have slight variations on speed of transactions, security of the network & privacy of the network. These come closest to being the equivalent of currencies “Tokenisation is to and when considering the quantitative theory of money, their dynamics might be understood with the equation of exchange (MV = PQ). OWNERSHIP Stablecoins aim to decouple the volatility from cryptoassets and provide a digital asset as digitisation was to that is pegged to a fiat counterpart (e.g. USD) and mainly used as a unit of account & medium of exchange. The 3 large categories include: content.” • Centralised IOU Issuance - kept stable by an equal reserve of fiat that is centrally held. • Collateral Backed - over-collateralised by cryptoassets such as Ether escrowed trustlessly. Types of tokens • Seignorage Shares - recreating an algorithmic central bank that keeps stability with levers on supply and demand. Diving into the universe of tokens, we classify the different characteristics into three core categories: Currencies & Commodities, Utility Tokens and Security Tokens. Bearing Payment Tokens have been the simplest and most iterated version - they’ve often been in mind that any individual token might exhibit several of the characteristics at the forcibly implemented into networks as the sole method of payment for the digital asset same time or even evolve their characteristics over their life cycle of the underlying provided by the network. As a result, they come close to being currencies within a digital network, we have summarised our view of these characteristics below: economy, without ever becoming investable, liquid or stable enough to become stores of value. Instead, at a future equilibrium, they’ll look closer to a form of working capital, which users will try to minimise due to the opportunity cost of capital. As a result, they A Taxonomy of Token are likely to end up with an extremely high velocity, but a low value accrual. Through the Characteristics nature of open source code (copyable & forkable), these token models run at a high risk of being forked and replaced by equivalent protocols that enable payments in a proper SoV token. Security Tokens are a tokenised representation of assets ranging from traditional commodities & equities, to pieces of art and all the way to pieces of virtual land in the form of crypto collectibles. The former rely on a strong guarantee of ownership of the underlying asset and can be valued by the worth of their underlying asset with a premium for liquidity, divisibility and accessibility. The latter often represents scarce digital assets that are valued like art or real estate - i.e. fame of creator, location in a digital landscape & overall demand for asset. Governance Tokens give the holders a vote in how a network is run, where developers focus their efforts & when software upgrades should be implemented. As the value of Graphic 4: Taxonomy of token characteristics, Fabric Ventures a network goes up - via the number of companies running on top of it or the number 38 39

State of the Token Market Page 37 Page 39

State of the Token Market Page 37 Page 39